Worldwide Insurance Company Logos by Country. Easily access the websites of insurers in the world, sorted by continent and country. You can find the latest information about each assurance company. Just click on the logo images for the regions:

Asia

Africa

America

Oceania

Europe

Caribbean

Discover the best coverage providers based on cost, protection, customer service, and claims support. The world’s insurers you can have confidence in!

Global Insurance Logos: A Comprehensive Guide

Discover a global directory of insurance company logos, organized by country. Click on a logo to get the latest information on products and services. This will help you find the right coverage.

Insurance: A Shield Against Uncertainty

Insurance is a financial tool that transfers risk from one entity to another. By paying a premium, an individual or business can protect themselves from potential financial losses.

How it works:

- Insurer: The company that provides insurance coverage.

- Insured: The individual or business purchasing the insurance policy.

- Premium: The fee paid to the insurer for coverage.

The Benefits of Insurance:

Insurance offers peace of mind by safeguarding against unforeseen events. It provides financial security and stability, enabling individuals and businesses to focus on their goals without worrying about potential risks.

Risk Management: A Strategic Approach

Risk management is the process of identifying, assessing, and controlling risks. By implementing effective risk management strategies, individuals and businesses can minimize the impact of potential losses. Insurance plays a crucial role in a comprehensive risk management plan.

Insurance Types: Life, Health, Car, Property, and More Explained

The main types of insurers can be categorized as:

- Life insurance: This type of coverage gives financial protection to the policy owner’s family or dependents if they die. It may also offer additional benefits, such as savings and investment possibilities.

- Health assurance: This protection pays for medical treatment and hospital costs if you get sick, hurt, or disabled. It can cover hospital costs, physician visits, prescription medications and other medical expenses.

- Property assurance: This coverage protects you from damage or loss of property. It covers issues like fire, theft, or natural disasters. This may include protection of houses, businesses and other types of property.

- Car assurance: This policy provides coverage for cars, trucks and other vehicles from damage, theft, and accidents. It may also cover bodily injury and third-party liability.

- Third Party Liability insurance: This policy protects you from legal claims and lawsuits. It covers accidents, injuries, or damage caused by you. It can be acquired by individuals or companies.

- Travel assurance: This policy provides coverage for unexpected events during your trip. This includes travel cancellations, lost baggage, medical emergencies, and more.

- Specialized coverage includes different niche products. These products meet specific needs and risks. Examples are pet insurance, wedding coverage, and cyber protection.

It is important to know that there are many subcategories in each of these areas. Protection products can vary a lot based on the supplier and the market they serve.

How Big Are Insurers? Key Metrics and What They Mean to You

With respect to the measurement of the size of insurers, certain common measures are

- Premiums written: The amount of money an insurer makes selling policies over a period of time. It is often used to measure the size of an insurer.

- Assets under management: Includes the value of all assets managed by an insurer, including investments and policyholder reserves.

- Market capitalization: This is the total value of an Assurance

Coverage

Protection

Guarantee

Policy’s outstanding shares and can be used as a measure of its overall size and value. - Number of employees: This is another way to show how big an insurer is. However, it is not always reliable. Some insurers hire outside help for many tasks and have smaller teams.

It is important to note that the size of an insurer may not be related to its financial stability or performance.

Top Insurance Providers by Country: Find the Best Options Around the World

Insurance Company Logos: Find the best options around the world. Use this infographic to find the insurer that fits your needs.

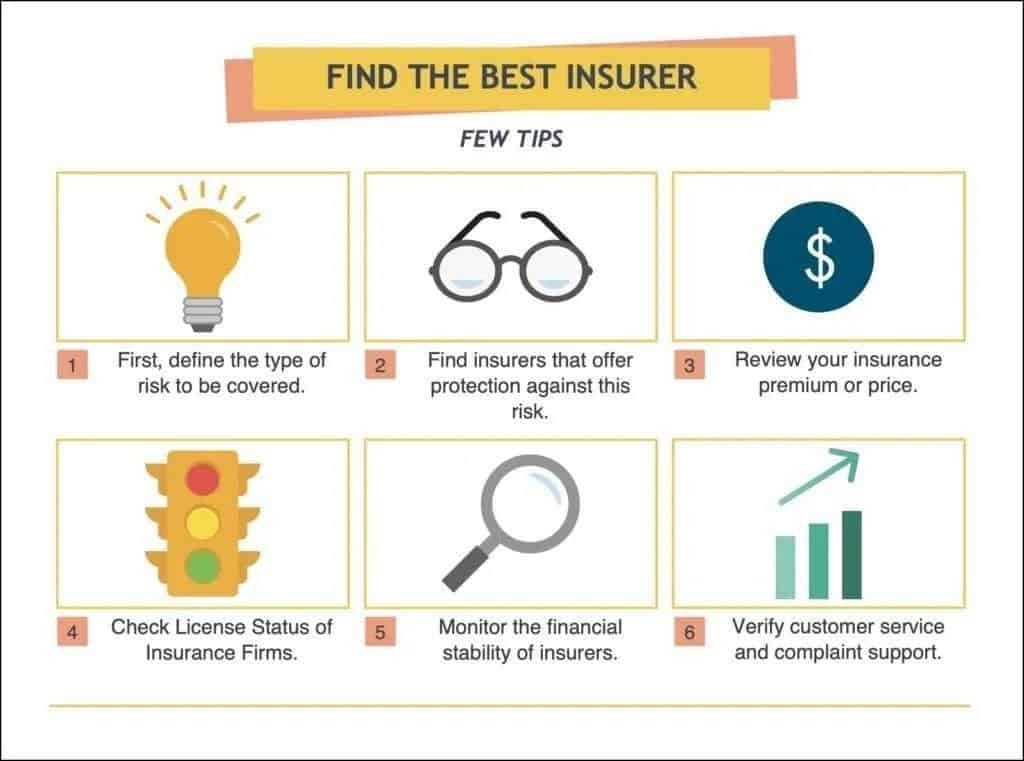

Top Tips for Choosing the Right Assurance Provider by Country: What to Consider Before You Buy

Here are some tips to keep in mind when selecting the insurer that best fits your needs.

Firstly, define the type of cover you require.

Identify the type of risk you need coverage for. Then, look for insurers that provide protection for that risk.

Secondly, select the approved providers.

Choose the names of insurers that provide you with the greatest financial security against this detrimental event.

Thirdly, check your premium or price

For each selected insurer, you need to:

- Please review the status of the insurer’s license. Insurers are required to be licensed in the jurisdiction where they sell coverage. To ensure peace of mind, it is essential to purchase coverage from an authorized provider in your area. You can do this by checking with your country’s insurance department, either online or over the phone.

- To check the financial stability of the underwriter, it is best to look up the provider’s financial strength. Use trusted sources like A.M. Best, Standard & Poor’s, Moody’s, or Fitch. These organizations provide valuable insights into the financial standing of insurers. This is particularly useful when dealing with smaller or lesser-known suppliers, as it helps ensure a safe choice.

- Please verify the client service and claims support by reviewing the consumer claim ratios. Many assurance companies’ websites provide consumer complaint reports for their providers. The consumer complaint ratio is calculated by dividing the number of complaints received by an insurer by the number of claims made by its underwriters, multiplied by 1,000.

It is also a good idea to check the complaint report of a provider in another country. Their scores can be different in various parts of the world

Insurance Company Logos by Country – World Insurance Companies Logos