Europe features a mature and diverse insurance market, with a multitude of companies offering a comprehensive range of products and services. From multinational giants to specialized local insurers, there’s an option for every need.

Europe features a mature and diverse insurance market, with a multitude of companies offering a comprehensive range of products and services. From multinational giants to specialized local insurers, there’s an option for every need.

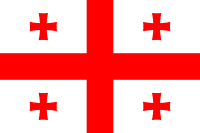

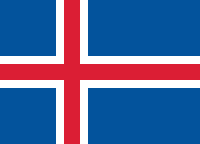

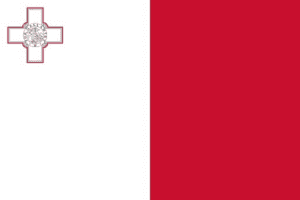

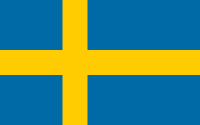

Our directory simplifies your search for insurance providers across Europe. By clicking on the flag or name of each European country below, you can easily access the logos and direct links to each insurer. This allows you to quickly find the latest information about the coverage they offer directly on their websites.

Explore European Insurer Logos by Country

Find a comprehensive list of insurance company logos and names in Europe, sorted by country, for fast and easy access to leading insurers located in every European nation.

Leading European Insurance Companies

Some of the largest and most well-known European insurers include:

- Allianz (Germany): A multinational financial services company providing insurance and asset management in over 70 countries.

- AXA (France): A multinational insurer offering a range of products, including life, health, property, and casualty insurance.

- Zurich Insurance Group (Switzerland): Provides insurance products and services to customers in more than 170 countries.

- Generali (Italy): A multinational insurer with customers in over 60 countries.

- Aviva (United Kingdom): Offers a range of products including life, health, property, and casualty insurance.

- Aegon (Netherlands): A multinational life insurance, pensions, and asset management company operating in over 20 countries.

- NN Group (Netherlands): Provides insurance, pensions, and asset management products in Europe and Japan.

- Prudential PLC (United Kingdom): A multinational financial services company providing insurance and asset management to customers in Asia, the US, and Africa (with its base in Europe).

Tips for Choosing an Insurance Company in Europe

Finding the right insurance in Europe requires careful consideration. Here are some tips:

- Determine Your Coverage Needs: Before comparing companies, identify the specific type of coverage you need. This will allow for a proper comparison of quotes from various insurers.

- Verify Licensing: Insurers must be licensed by the country in which they operate. Confirm you’re dealing with a licensed provider by checking with your country’s insurance regulatory body, often available online or by phone.

- Assess Financial Stability: Research an insurer’s financial strength ratings on the websites of agencies like A.M. Best, Standard & Poor’s, Moody’s, or Fitch. This is particularly important for smaller, lesser-known providers.

- Evaluate Customer Service and Claims Support: Check consumer complaint ratios, which many insurance regulators publish. This ratio often indicates the number of complaints per 1,000 claims. Reviewing ratios across multiple countries can be insightful, as service quality can vary.

The European Insurance Landscape: Key Context

Europe’s well-developed economy and comprehensive healthcare systems shape its insurance market.

Healthcare Systems and Insurance

Most European countries offer some form of universal healthcare, ensuring residents have access to basic services. This is typically financed through taxation, social security, or mandatory health insurance schemes involving public and/or private insurers. While universal systems provide a foundation, private health insurance often complements public offerings, covering additional services or providing faster access.

Economic Environment

Europe is a high-income region, with the European Union (EU) forming a significant single market. Key sectors include services (finance, tourism) and advanced manufacturing. This economic stability and high standard of living drive demand for a wide array of insurance products, from life and health to property, casualty, and business insurance. Financial centers like London, Frankfurt, and Zurich play a crucial role in the global insurance and reinsurance markets.

Discover Insurers Worldwide

Return to our main directory to World Insurance Companies Logos and Insurers by Country

Or, view other regions directly

- African Insurance Company Logos

- Directory of Asian insurance company logos and names

- Directory of American insurance company logos and names

- Caribbean Insurance Company Logos post

- South American insurance company logos and names

- Oceanian Insurance Company Logos

© 2025 World Insurance Companies Logos and Insures by Country

Navigating Spain’s competitive insurance market can be a challenge, especially if you’re new to the country. From protecting your car and home to securing your family’s health and financial future, choosing the right company is a crucial decision.

Navigating Spain’s competitive insurance market can be a challenge, especially if you’re new to the country. From protecting your car and home to securing your family’s health and financial future, choosing the right company is a crucial decision.

Ukraine Insurance – World Insurance Companies Logos. Find the best insurer, according to cost, coverage, customer service, and disaster support. Find the provider you trust

Ukraine Insurance – World Insurance Companies Logos. Find the best insurer, according to cost, coverage, customer service, and disaster support. Find the provider you trust

Slovakia Insurance – World Insurance Companies Logos. Research and compare insurers to find the one that best suits your needs.

Slovakia Insurance – World Insurance Companies Logos. Research and compare insurers to find the one that best suits your needs.

Sweden Insurance – World Insurance Companies Logos. Monitor the best insurers in Sweden, according to cost, coverage, customer service and claims support. Find the insurer you trust.

Sweden Insurance – World Insurance Companies Logos. Monitor the best insurers in Sweden, according to cost, coverage, customer service and claims support. Find the insurer you trust.

Slovenia Insurance – World Insurance Companies Logos. Watch out for the best insurers in Slovenia, depending on cost, coverage, customer service and claims support. Find the insurer you trust.

Slovenia Insurance – World Insurance Companies Logos. Watch out for the best insurers in Slovenia, depending on cost, coverage, customer service and claims support. Find the insurer you trust.

Insurance in Switzerland – World Insurance Companies Logos. Insurance Companies Logos in Switzerland. Monitor leading providers based on cost, coverage, customer service and claims support. Find the insurer you trust.

Insurance in Switzerland – World Insurance Companies Logos. Insurance Companies Logos in Switzerland. Monitor leading providers based on cost, coverage, customer service and claims support. Find the insurer you trust.